hankyoreh

Links to other country sites 다른 나라 사이트 링크

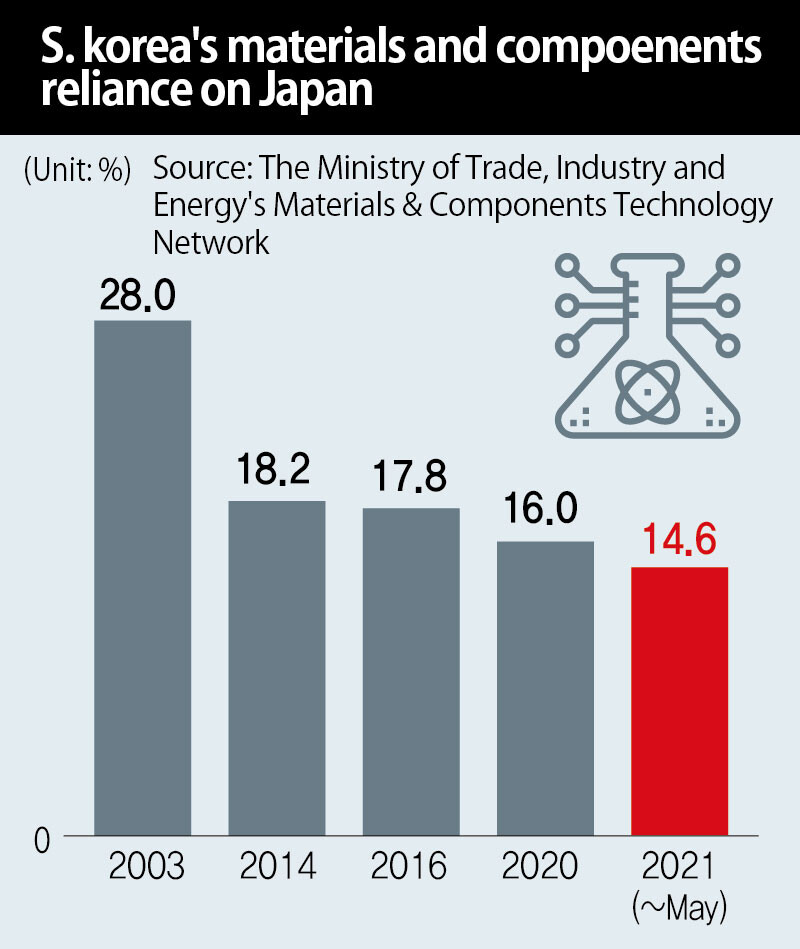

S. Korea's materials and components reliance on Japan declined across the board since 2019 trade dispute

South Korea's reliance on Japan for materials and components has been declining across the board ever since Japan intensified control on exports of key materials to South Korea in July 2019.

Dependence on Japan for three key materials — high-purity hydrogen fluoride, extreme ultraviolet (EUV) photoresists, and fluorinated polyimides — has gradually declined. But South Korea still remains heavily dependent on Japan for all three of them, which analysts are pointing to as an issue to be resolved going forward.

On Sunday, HS Code-based Korea International Trade Association figures showed US$358,549,000 in imports of photoresists — considered especially important among the three items subject to export controls — between July 2020 and May 2021.

Imports from Japan totaled US$304,259,000, or 84.9%. The rate was down from 92.9% between July 2018 and June 2019 and 86.8% between July 2019 and June 2020.

South Korea's reliance on Japan for hydrogen fluoride imports fell from 42.9% for the period July 2018-June 2019, before the export controls were imposed, to 9.0% for the period July 2019-June 2020.

Between July 2020 and May 2021, the percentage bounced back to 14.0%, but analysts attributed this more to an adjustment — after the post-export controls plunge from the 40-percent range down to the single digits — while concluding that the overall trend has been one of decline.

The situation for polyimides has been somewhat different. Dependence on Japan remained more or less unchanged over the same periods at 93.0%, 92.4%, and 94.2%. The numbers show both some positive results and some limitations in South Korea's efforts to wean itself off of Japanese imports.

"There haven't been any major issues in the two years since the export controls were imposed, and supplies of the items in question are seen as stable," said Yoon Chang-hyun, director of the materials, components, and equipment department of the South Korean Ministry of Trade, Industry and Energy (MOTIE).

"Our dependence on Japan has been declining across the board," he said, attributing this to "the building and expansion of production facilities by South Korean businesses, efforts to court foreign capital, and diversification of import sources."

An example of successfully wooing a foreign business came when the US company DuPont decided last year to invest in South Korea to produce photoresists. Another achievement in import source diversification came when Belgium was added as a source of photoresists, which had previously come exclusively from Japan.

The general decline in reliance on Japan was even greater for materials and components in general, including the three aforementioned items.

According to figures from the MOTIE's Materials & Components Technology Network, South Korea's cumulative materials and components imports between January and May 2021 totaled US$81.37 billion, with Japanese products accounting for US$11.871 billion of that or 14.6%. The rate was down from 15.7% during the same period in 2020.

The percentage of South Korean materials and components imports coming from Japan peaked at 28.0% in 2003 and has been gradually falling since then, reaching 18.2% in 2014, 17.8% in 2016, and 16.0% in 2020.

Korea Trade-Investment Promotion Agency CEO Yu Jeoung-yeol oversaw the development of South Korea's measures to foster its materials, components, and equipment production as director of the MOTIE's industrial policy division at the time Japan's export controls were imposed.

"This is an excellent illustration of the South Korean public, businesses, public institutions, and government coming together to respond to Japan after its actions increased uncertainties for the South Korean economy," he said.

"It's significant as an example of a mood of solidarity and cooperation growing among various actors in the generally inaccessible area of materials, components, and equipment, which is characterized by a narrow market and high levels of technological skill," he added.

He described the response to Japan's export controls as having "given even the businesses responsible for [materials and components] demand a renewed awareness of the need to re-examine their supply chain and their dependence on particular countries, and to build an ecosystem of close-knit cooperation with SME suppliers."

Hwang Cheol-ju, president of the semiconductor equipment company Jusung Engineering, agreed that the situation has led to closer cooperation between the large companies responsible for materials and components demand and the small businesses tasked with meeting it.

"Japan's measures have ended up creating a positive environment in South Korea by strengthening cooperative ties and reinforcing the importance of materials, components and equipment," he said.

"In one year, they did something that would have taken 10 years in the past," he added.

Some issues remain to be addressed. Reliance on Japan for key materials is still high in absolute terms, raising the specter of instability.

Yoon Chang-hyun said, "We have no way of knowing when Japan's controls might be increased again, and efforts to revise the international supply chain have also emerged as a variable."

"Materials, components, and equipment are an area where continuous strides have been made with technology, so it's crucial that our current policies and programs are pursued in a steady and consistent fashion," he added.

He went on to share plans for "policy efforts not only to stabilize supply chains and support R&D investment but also to translate the technology that has been developed into mass production of items."

By Kim Young-bae, senior staff writer

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1After election rout, Yoon’s left with 3 choices for dealing with the opposition

- 2AI is catching up with humans at a ‘shocking’ rate

- 3Noting shared ‘values,’ Korea hints at passport-free travel with Japan

- 4Two factors that’ll decide if Korea’s economy keeps on its upward trend

- 5Why Kim Jong-un is scrapping the term ‘Day of the Sun’ and toning down fanfare for predecessors

- 6South Korea officially an aged society just 17 years after becoming aging society

- 7Korea’s 1.3% growth in Q1 signals ‘textbook’ return to growth, says government

- 8Is Japan about to snatch control of Line messenger from Korea’s Naver?

- 91 in 5 unwed Korean women want child-free life, study shows

- 10[Reportage] On US campuses, student risk arrest as they call for divestment from Israel